Calculating Salary

Knowledge is your strongest negotiating tool. Whether you’re exploring a new salaried position, freelancing, or planning your financial future, understanding the true annual value of your hourly wage is crucial. This Calculating Salary Converter helps you translate your time into tangible numbers. Easily compare compensation packages, set freelance rates, or budget your income with a complete breakdown of your projected yearly, monthly, and weekly earnings.

Ultimate Calculating Salary Converter Guide for 2025: Master Your Income Conversion

Why Accurately Calculating Salary Matters More Than Ever

Understanding the true value of your hourly wage is a fundamental financial skill, whether you’re negotiating a new job offer, planning your freelance consulting rates, or simply budgeting your monthly income. A precise conversion from an hourly rate to an annual salary (and vice versa) reveals your actual earning potential, helps you compare job offers fairly, and is essential for tax planning and financial forecasting. In today’s diverse economy, with more freelancers, remote workers, and hybrid roles than ever, having a reliable 2025 Calculating Salary converter is not just helpful—it’s critical for making informed career and financial decisions.

This comprehensive guide provides everything you need: an easy-to-use mental framework, the exact mathematical formulas, a detailed breakdown of key variables, and expert insights to ensure you’re never underpaid again.

Quick Reference: Hourly Wage to Annual Calculating Salary Conversions

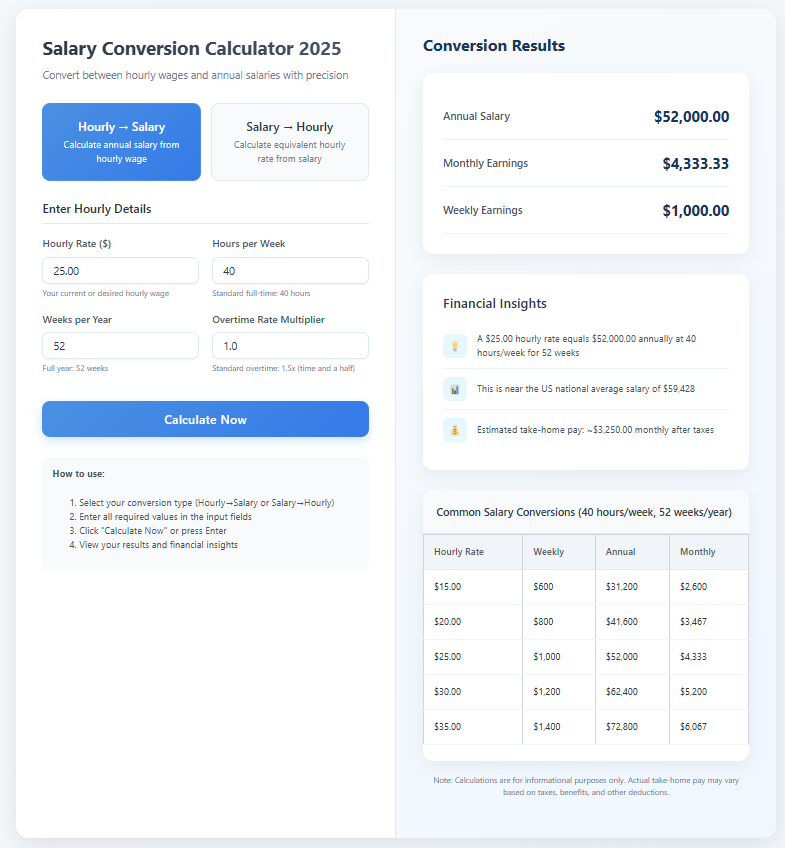

For a standard full-time role at 40 hours per week for 52 weeks, here’s how common hourly wages translate into gross annual salaries:

| Hourly Wage | Weekly Pay (40 hrs) | Monthly Pay (Approx.) | Annual Salary |

|---|---|---|---|

| $15.00 | $600 | $2,600 | $31,200 |

| $20.00 | $800 | $3,467 | $41,600 |

| $25.00 | $1,000 | $4,333 | $52,000 |

| $30.00 | $1,200 | $5,200 | $62,400 |

| $35.00 | $1,400 | $6,067 | $72,800 |

| $40.00 | $1,600 | $6,933 | $83,200 |

| $50.00 | $2,000 | $8,667 | $104,000 |

| $75.00 | $3,000 | $13,000 | $156,000 |

*Note: These are gross, pre-tax salaries based on 2,080 annual work hours (40 hrs/week x 52 weeks). Actual take-home pay will be lower after taxes and deductions.*

The Core Formula: How to use Calculating Salary Converter Accurately

The basic formula for converting your hourly wage to an annual salary is straightforward:

Hourly Wage × Hours Worked Per Week × Weeks Worked Per Year = Annual Salary.

For a standard full-time position:

Hourly Wage: Your pay per hour (e.g., $25.00).

Hours Per Week: Typically 40 for full-time roles.

Weeks Per Year: The total number of weeks you work. Using 52 weeks assumes no unpaid time off.

Example: $25/hour x 40 hours/week x 52 weeks/year = $52,000/year.

However, this “quick math” often doesn’t reflect reality. To get your true annual salary, you must account for variables like paid time off (PTO), holidays, and your actual work schedule. Calculating Salary Converter is your companion.

The Adjusted Formula for a Realistic Salary

For a more accurate picture, use this adjusted calculation:

(Hourly Wage × Weekly Hours × 52) – (Hourly Wage × Weekly Hours × Weeks of Unpaid Time Off)

If you receive 10 days of PTO and have 8 paid holidays (totaling 18 paid days off, or about 3.6 work weeks), your adjusted working year is 48.4 weeks.

Accurate Example: $25/hour x 40 hours/week x 48.4 weeks = $48,400/year.

The $3,600 difference from the quick calculation highlights why using a precise salary paycheck calculator is essential for financial planning. Calculating Salary Converter is your companion

Key Factors That Impact Your Final Calculating Salary Number

Beyond the basic math, several variables significantly affect your take-home pay. An advanced calculator will account for these to give you a complete financial picture.

Paid Time Off (PTO) & Holidays: Unpaid days off directly reduce your annual income. Conversely, paid vacation and sick days mean you are compensated for time not worked, preserving your salary.

Overtime Pay: If you are a non-exempt employee, hours worked beyond 40 in a week are typically paid at 1.5x your hourly rate (time-and-a-half). This can substantially increase your annual earnings.

Taxes and Deductions: Your gross salary is not what you take home. Federal and state income taxes, Social Security, Medicare, and deductions for health insurance or retirement contributions (like a 401(k)) will lower your net pay.

Work Schedule Variations: Do you work a consistent 40-hour week, or does it fluctuate? Are you part-time (e.g., 30 hours/week)? Input your average weekly hours for the most reliable estimate.

Essential Use Cases for a Calculating Salary Converter

This tool is indispensable in several real-world scenarios:

Comparing Job Offers: Is a $55,000 annual salary better than a $28 per hour contract? A converter normalizes different pay structures for an apples-to-apples comparison.

Freelance & Consulting Rate Setting: Freelancers must translate their desired annual income into an hourly or project rate that accounts for business expenses, taxes, and non-billable time. As experts note, consultants often move beyond hourly rates to project-based or value-based fees as they gain experience, but the hourly calculation remains the foundational starting point.

Budgeting and Financial Planning: Knowing your exact monthly and daily take-home pay is crucial for managing rent, loan payments, and savings goals.

Evaluating Raises or Side Hustles: Calculate exactly how much a $3 raise adds to your monthly income, or determine the annual impact of a weekend side gig.

📊 Comprehensive FAQ: Calculating Salary Converter Explained

1. How do I calculate my annual salary if I work part-time?

Use the same core formula but with your actual weekly hours: Hourly Wage × Weekly Hours × 52. For example, at $20/hour working 25 hours/week: $20 × 25 × 52 = $26,000 annually. Always use your average hours if they fluctuate. Calculating Salary Converter is your companion

2. How does overtime affect in calculating Salary?

Overtime (typically hours over 40/week) is paid at 1.5x your regular rate. Calculate separately:

Regular pay: Hourly Rate × 40 hours × 52 weeks

Overtime pay: (Hourly Rate × 1.5) × Overtime Hours × 52 weeks

Add both amounts for total annual salary. Even 2-3 overtime hours weekly can significantly increase annual earnings. Calculating Salary Converter is your companion

3. What’s the difference between gross salary and take-home pay?

Gross Salary: Total earnings before any deductions (what we calculate with the hourly converter)

Take-Home Pay: Amount actually deposited after taxes, insurance, retirement contributions, etc.

Use a net pay calculator after determining gross salary to estimate actual disposable income.

4. How do I account for paid time off for calculating salary?

If you receive paid vacation/sick days, you’re paid for time not worked. Simply use the standard formula (Hourly × Hours × 52) since you’re paid for all 52 weeks. Only subtract unpaid weeks from the “52” multiplier if time off is unpaid. Hourly to Salary Converter is your companion

5. Is $XX per hour a good salary?

This depends entirely on location, industry, and experience. Research tools like:

Bureau of Labor Statistics Occupational Data

Glassdoor Salary Explorer

LinkedIn Salary Tool

Compare your rate to local averages for your position. Remember that benefits (healthcare, retirement matching) add significant value beyond hourly rate alone.

6. How do I convert an annual salary back to an hourly rate?

Annual Salary ÷ (Weekly Hours × 52) = Hourly Rate. Example: $60,000 ÷ (40 × 52) = $28.85/hour. For salaried positions, this helps understand the hourly value of your time, especially when comparing to hourly opportunities. Calculating Salary Converter is your companion

7. What if I have multiple jobs with different hourly rates?

Calculate each job separately using its respective rate and average hours, then sum the annual totals. This comprehensive view is crucial for tax planning and understanding your true earning capacity across all income streams.

🔄 Reverse Calculation: Salary to Hourly Converter

Many professionals need to convert in the opposite direction—understanding what their salary equates to hourly, especially when evaluating overtime expectations or side opportunities.

The Salary to Hourly Formula

Annual Salary ÷ (52 weeks × Hours Per Week) = Hourly Rate

| Annual Salary | 40 Hours/Week | 45 Hours/Week | 50 Hours/Week |

|---|---|---|---|

| $50,000 | $24.04/hour | $21.37/hour | $19.23/hour |

| $75,000 | $36.06/hour | $32.05/hour | $28.85/hour |

| $100,000 | $48.08/hour | $42.74/hour | $38.46/hour |

This reveals how increased weekly hours without additional pay decreases your effective hourly rate—a critical consideration when evaluating job demands.

🧮 Advanced Calculations: Beyond the Basics

Factoring in Benefits and Deductions

Your total compensation extends beyond hourly wage. Consider:

Health insurance contributions (employer-paid premiums can equal $6,000+ annually)

Retirement matching (typically 3-6% of salary)

Paid time off value (2-4 weeks can equal 4-8% of salary)

Bonuses and commissions (add to base calculations)

A comprehensive total compensation calculator should include these elements for accurate comparisons.

Variable Schedule Calculations

For irregular hours, track your hours over 4-6 weeks to establish an accurate average:

Sum all hours worked during the period

Divide by number of weeks tracked = Average weekly hours

Apply standard formula with your average

Self-Employment and Freelance Considerations

Freelancers must calculate differently to account for:

Self-employment taxes (additional 7.65% over employee rates)

Business expenses and overhead

Unbillable time (marketing, administration)

Lack of benefits (must fund independently)

Freelancer Formula: (Desired Salary + Expenses + Tax Burden) ÷ Billable Hours = Minimum Hourly Rate

📈 2025 Tax Considerations for Accurate Calculations

Recent tax changes significantly impact net income calculations:

Updated tax brackets and standard deductions

Changes to retirement contribution limits affecting taxable income

State-specific minimum wage increases in multiple jurisdictions

Remote work tax implications for cross-state workers

Always use a 2025 tax calculator after determining gross income for precise take-home estimates, especially if you work across state lines or have multiple income sources. Calculating Salary Converter is your companion

🛠️ Practical Applications: Real-World Scenarios

Job Offer Comparison Template

| Consideration | Job A (Hourly) | Job B (Salary) | Comparison Tip |

|---|---|---|---|

| Base Rate | $32.00/hour | $67,000/year | Convert both to annual: $66,560 vs $67,000 |

| Hours/Week | 40 guaranteed | 45 expected | Calculate effective hourly: $32.00 vs $28.72 |

| Overtime | 1.5x after 40 | No additional pay | Project 5 OT hours/week: +$12,480 annually |

| PTO | 10 days unpaid | 15 days paid | Value: $0 vs ~$3,860 in paid time off |

| Benefits | Basic health | Full package | Estimate value: $5,000 vs $12,000 annually |

| Total Value | $84,040 | $82,860 | Include ALL compensation elements |

Negotiation Preparation Guide

Research industry standards for your role and region

Calculate your current total compensation (not just hourly rate)

Determine your minimally acceptable rate based on expenses

Calculate your target rate based on market data + experience

Practice discussing your value in both hourly and annual terms

🔍 Common Calculation Mistakes to Avoid

Forgetting unpaid time off – Assuming 52 paid weeks when you have 3 weeks unpaid reduces income by ~5.8%

Ignoring overtime potential – Some hourly roles offer substantial overtime; some salaried roles demand excessive unpaid overtime

Overlooking benefit values – Health, retirement, and PTO can increase total compensation 20-40%

Using wrong weekly hours – Assuming 40 when you regularly work 45 distorts comparisons by 12.5%

Neglecting tax differences – 1099 vs W-2, state variations, and deductions significantly affect net income

💡 Pro Tips for Maximum Earnings Accuracy

Track your actual hours for 2-4 weeks using apps like Toggl or Clockify for precise averages

Calculate both directions – hourly to annual AND annual to hourly for complete perspective

Update calculations quarterly – as tax laws, expenses, and personal situations change

Create personalized templates in Excel/Google Sheets with your specific variables

Consult tax professionals when dealing with complex situations like multiple states or self-employment

📱 Using Our Advanced Calculating Salary Converter Tool

For precise, personalized calculations, use our integrated 2025 Calculating Salary Converter which automatically factors in:

Your specific state and local tax rates

Updated 2025 deduction allowances

Benefit valuation based on your selections

Overtime projections based on your industry averages

Side-by-side comparison of up to 3 job scenarios

Simply enter your base hourly rate, average weekly hours, state of residence, and benefit details for a comprehensive total compensation analysis that updates in real-time as you adjust variables.

Bottom Line: Whether you’re comparing job offers, planning freelance rates, or simply understanding your earning potential, accurate hourly-salary conversion requires looking beyond basic multiplication. By considering overtime, benefits, taxes, and industry context, you can make truly informed financial decisions. Bookmark this guide and use our integrated calculator for the most precise 2025 calculations available.