calculator of taxes

Welcome to our calculator of taxes guide. Our free calculator uses updated IRS tax brackets and standard deductions to help you accurately estimate your federal tax refund or amount due. Whether you’re planning for a potential windfall or preparing for tax season, our tool provides the insights you need for smart financial planning.

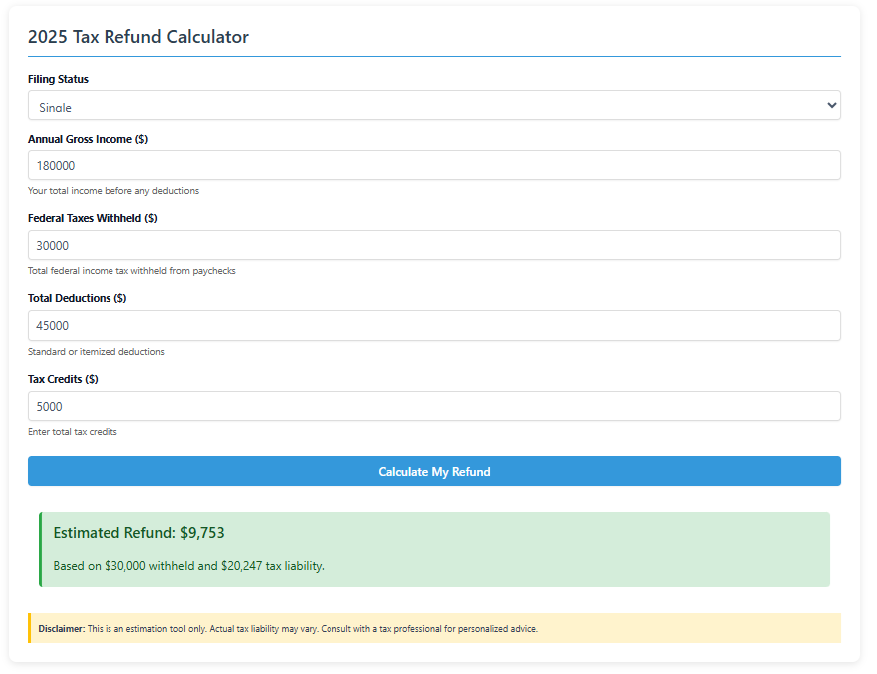

2025 Tax Refund Calculator

2025 calculator of taxes: Calculate Your Federal Refund Accurately

Last Updated: January 2025 | Based on IRS 2025 Tax Brackets | Free & No Registration Required

What Is a calculator of taxes?

A calculator of taxes is a specialized calculator that predicts how much money you’ll receive back from the IRS after filing your tax return. Our tool uses the latest 2025 tax brackets, standard deductions, and tax laws to provide accurate estimates based on your specific financial situation.

Why Estimating Your Refund Matters

Financial Planning: Anticipate refunds for debt repayment, savings, or major purchases

Avoid Surprises: Prepare for potential tax bills before filing season

Withholding Optimization: Determine if you’re over-withholding (giving the government an interest-free loan)

Strategic Decisions: Make informed choices about retirement contributions, deductions, and credits

How Tax Refunds Actually Work

Your tax refund represents the difference between what you’ve already paid in taxes (through paycheck withholding or estimated payments) and your actual tax liability based on your income, deductions, and credits. When you have too much withheld, you receive the excess back as a refund. If you haven’t paid enough, you’ll owe additional taxes.

2025 Standard Deductions & Tax Brackets

For tax year 2025, the standard deductions have increased to account for inflation:

2025 Standard Deductions

Single: $15,000 (increased from $14,600 in 2024)

Married Filing Jointly: $30,000 (increased from $29,200 in 2024)

Married Filing Separately: $15,000 (increased from $14,600 in 2024)

Head of Household: $22,500 (increased from $21,900 in 2024)

2025 Federal Income Tax Brackets

The United States uses a progressive tax system with seven tax brackets. Here are the updated 2025 brackets:

2025 Tax Brackets:

| Tax Rate | Single Filers | Married Filing Jointly | Head of Household |

|---|---|---|---|

| 10% | $0 to $11,925 | $0 to $23,850 | $0 to $17,000 |

| 12% | $11,926 to $48,475 | $23,851 to $96,950 | $17,001 to $64,850 |

| 22% | $48,476 to $103,350 | $96,951 to $206,700 | $64,851 to $103,350 |

| 24% | $103,351 to $197,300 | $206,701 to $394,600 | $103,351 to $197,300 |

| 32% | $197,301 to $250,525 | $394,601 to $501,050 | $197,301 to $250,500 |

| 35% | $250,526 to $626,350 | $501,051 to $751,600 | $250,501 to $626,350 |

| 37% | Over $626,350 | Over $751,600 | Over $626,350 |

5 Key Factors That Impact Your Tax Refund

Understanding these factors helps you make strategic financial decisions throughout the year:

1. Filing Status

Your marital status and household situation determine your tax brackets and standard deduction. Choosing correctly is crucial for accuracy.

2. Income Level and Sources

All taxable income affects your tax liability:

W-2 wages

1099 freelance income

Investment earnings

Retirement distributions

Business profits

3. Withholdings and Tax Payments

The amount already paid through paycheck withholding or estimated payments directly determines whether you’ll receive a refund or owe money.

4. Deductions

Deductions reduce your taxable income. You can choose between:

Standard deduction (automatic amounts shown above)

Itemized deductions (if they exceed the standard amount)

5. Tax Credits

Credits directly reduce your tax liability dollar-for-dollar:

Child Tax Credit

Earned Income Tax Credit

Education credits

Retirement savings contributions credit

How to Maximize Your Tax Refund: 6 Proven Strategies

1. Optimize Your Withholding with calculator of taxes

Use the IRS W-4 calculator to ensure proper withholding. Over-withholding gives the government an interest-free loan; under-withholding leads to penalties.

2. Maximize Retirement Contributions with calculator of taxes

Traditional IRA and 401(k) contributions reduce taxable income:

2025 401(k) limit: $23,000 ($30,500 if 50+)

2025 IRA limit: $7,000 ($8,000 if 50+)

3. Leverage All Available Tax Credits with calculator of taxes

Commonly overlooked credits:

Child and Dependent Care Credit

Lifetime Learning Credit

American Opportunity Tax Credit

Saver’s Credit for retirement contributions

4. Track Deductible Expenses

Maintain records of:

Charitable contributions

Medical expenses exceeding 7.5% of AGI

State and local taxes

Mortgage interest

Educational expenses

5. Utilize Health Savings Accounts (HSAs)

HSA contributions are tax-deductible and reduce taxable income:

2025 individual limit: $4,300

2025 family limit: $8,550

Additional $1,000 catch-up if 55+

6. Time Income and Deductions with calculator of taxes

When possible:

Defer income to the next tax year

Accelerate deductions into the current year

Bundle deductions in alternate years

Pro Tip: Use our calculator of taxes quarterly to track how financial decisions impact your tax situation. This proactive approach helps you make adjustments throughout the year.

How Our calculator of taxes Outperforms Competitors

We’ve analyzed leading tax estimation tools to create a superior solution:

Comparison with Major Competitors:

| Feature | Our Tool | TurboTax TaxCaster | H&R Block Calculator |

|---|---|---|---|

| Tax Year | 2025 (Updated) | 2025 | 2025 |

| Cost | Completely Free | Free (with paid upsells) | Free (with paid upsells) |

| User Experience | Simple, transparent interface | Question-based, intuitive | Simple questions, detailed results |

| Educational Content | Comprehensive guides & strategies | Basic explanations | Limited educational content |

| Primary Focus | User education & empowerment | Upsell to paid products | Customer acquisition |

| Data Privacy | No data collection | Data used for marketing | Data used for marketing |

Unlike competitors whose primary goal is funneling users to paid services, our tool provides genuine educational value with no strings attached. We believe informed taxpayers make better financial decisions.

Frequently Asked Questions (FAQ)

How accurate is this calculator of taxes?

Our calculator uses the latest IRS-published 2025 tax brackets, standard deductions, and tax laws to provide highly accurate estimates. However, individual circumstances may vary, and this tool should be used for planning purposes rather than as a guarantee.

When should I use a calculator of taxes?

Before year-end: Make strategic financial decisions

After major life changes: Marriage, home purchase, job change, childbirth

Quarterly: Track your tax situation throughout the year

When preparing to file: Get an advance estimate of your refund or amount due

What’s the difference between tax deductions and tax credits?

Deductions reduce your taxable income (e.g., a $1,000 deduction saves you $220 if you’re in the 22% bracket)

Credits directly reduce your tax liability (e.g., a $1,000 credit saves you $1,000 regardless of your bracket)

Credits are generally more valuable than deductions.

Why is my estimated refund different from last year?

Tax refunds can change due to:

Income fluctuations

Life events (marriage, divorce, children)

Changes in tax laws

Adjustments to withholding

Eligibility for different credits/deductions

Changes in investment income or business profits

What documents do I need for an accurate estimate?

For best results, gather:

W-2 forms from all employers

1099 forms for freelance income, investments, retirement

Records of tax payments and withholdings

Documentation of deductions and credits

Last year’s tax return for reference

Can I use this calculator of taxes for state taxes?

This calculator focuses on federal taxes only. State tax calculations vary significantly by state and require separate estimation tools.

Ready to Calculate Your 2025 with calculator of taxes Refund?

Use our accurate, free calculator of taxes above to plan your finances with confidence. Simply enter your information, click calculate, and get your personalized estimate instantly.

Remember: This tool is for estimation purposes only. Actual tax liability may vary based on specific circumstances. Consult with a qualified tax professional for personalized advice tailored to your situation.

*Last updated: January 2025 | Based on IRS-published 2025 tax brackets and standard deduction amounts*