Calculate 1099 Taxes

Stop wondering how much to save for taxes. Our free Calculate 1099 Taxes self employed Calculator provides a straightforward estimate of what you’ll owe. Simply input your estimated annual net profit, and we’ll calculate your federal self-employment tax (15.3%), your potential income tax, and your recommended quarterly estimated payment. Take control of your finances in less than a minute.

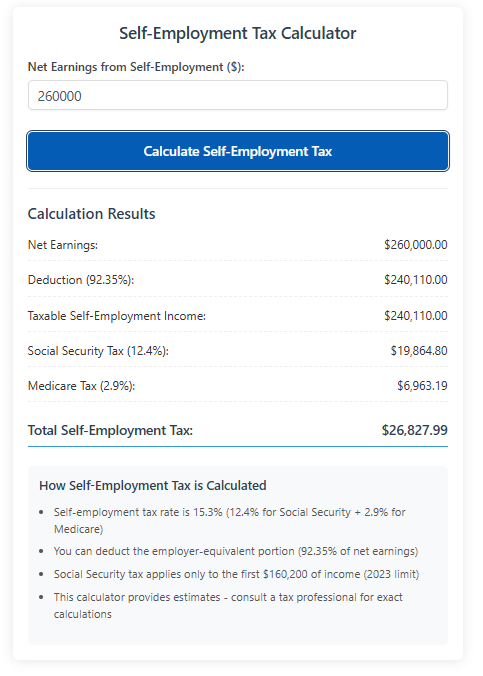

Calculation Results

How Self-Employment Tax is Calculated

- Self-employment tax rate is 15.3% (12.4% for Social Security + 2.9% for Medicare)

- You can deduct the employer-equivalent portion (92.35% of net earnings)

- Social Security tax applies only to the first $160,200 of income (2023 limit)

- This calculator provides estimates - consult a tax professional for exact calculations

Master Your Calculate 1099 Taxes Self-Employed : The Ultimate 2025-2026 Calculator & Strategy Guide

The Taxes Self Employed Challenge

For the 57 million freelancers, independent contractors, and small business owners in the U.S., calculate Calculate 1099 Taxes isn’t a simple year-end task—it’s a year-round financial puzzle. Taxes Self employed is a significant financial obligation, comprising Social Security and Medicare taxes that you must pay as both employee and employer. This 15.3% rate (12.4% for Social Security, 2.9% for Medicare) applies to your net earnings, but strategic planning can substantially reduce your liability.

This guide will not only explain how to calculate what you owe but will introduce a comprehensive approach to minimize your tax burden legally and effectively in 2025 and beyond.

Understanding Calculate 1099 Taxes Self Employed: The Basics

What Exactly Is taxes Self Employed?

When you work for yourself, you’re responsible for the full Federal Insurance Contributions Act (FICA) taxes. Traditional employees split this cost with their employers (each pays 7.65%), but as a self-employed individual, you bear the entire 15.3% burden. This tax funds your future Social Security and Medicare benefits. Calculate 1099 Taxes Self Employed Calculator is your companion.

Who Must Pay?

You must pay taxes self-employed, if your net earnings from self-employment were $400 or more in a tax year (or $108.28 or more from church employment). This applies regardless of your age—even if you’re already receiving Social Security or Medicare benefits. Calculate 1099 taxes Self Employed Calculator is your companion.

Key Income Thresholds for 2025-2026

Social Security Wage Base: Only the first portion of your combined earnings is subject to the 12.4% Social Security tax.

2025: $176,100

2026: $184,500 (projected)

Additional Medicare Tax: A 0.9% surtax applies to earnings exceeding:

$200,000 for Single filers

$250,000 for Married Filing Jointly

$125,000 for Married Filing Separately

How to Calculate 1099 Taxes Self-Employed: A Step-by-Step Method

Calculating your tax starts with determining your net earnings from self-employment. This is typically your business income minus your allowable business expenses, calculated on Schedule C (Form 1040). However, only 92.35% of your net earnings are subject to the self-employment tax Calculator.

The Calculation Formula

Calculate Net Earnings: Business Income – Business Expenses = Net Earnings

Determine Taxable Amount: Net Earnings × 92.35% = Amount Subject to SE Tax

Apply the Tax Rate: Taxable Amount × 15.3% = Preliminary SE Tax

Account for the Cap: Remember the Social Security wage base cap. If your taxable amount exceeds the cap, only apply the 12.4% Social Security portion to income up to the cap, while the 2.9% Medicare portion applies to all taxable earnings.

Add Additional Medicare Tax if Applicable: Add 0.9% to earnings above the threshold mentioned earlier.

A Practical Example for 2025

Let’s say you’re a freelance consultant with $85,000 in net earnings for 2025:

Taxable Amount: $85,000 × 92.35% = $78,497.50

Preliminary SE Tax: $78,497.50 × 15.3% = $12,010.12

Since $78,497.50 is below the 2025 Social Security cap of $176,100, the full calculation applies.

Your estimated Calculate 1099 Taxes self-employed would be $12,010.12.

Important Note: You can then deduct 50% of your Calculate 1099 Taxes self-employed calculator(the employer-equivalent portion) when calculating your adjusted gross income on your Form 1040. In this example, you could deduct $6,005.06.

Beyond Basic Calculate 1099 Taxes: Top Tax Reduction Strategies for 2025

Simply calculating taxes self employed what you owe is reactive. The real power lies in proactive strategies to reduce your taxable income. The following table compares some of the most effective methods.

| Strategy | How It Works | Best For | Potential Savings Impact |

|---|---|---|---|

| S Corporation Election | Pay yourself a “reasonable salary” (subject to employment tax); remaining profits are distributions (not subject to SE tax). | Businesses with >$50,000-$100,000 in annual profit. | Can cut SE tax liability by thousands on six-figure incomes. |

| Maximize Retirement Contributions | Contribute to a Solo 401(k) or SEP IRA. Contributions reduce your net profit. | Anyone with self-employment income; especially powerful for higher earners. | Up to $70,000 (Solo 401(k) limit for 2025) can be shielded from SE tax. |

| Deduct Health Insurance Premiums | 100% deduction for health, dental, and long-term care premiums for you, your spouse, and dependents. | All self-employed individuals not eligible for an employer-sponsored plan. | Directly reduces net earnings subject to the 15.3% tax. |

| Strategic Hiring of Family | Pay reasonable wages to spouse/children for legitimate work. Wages are a business deduction. | Business owners with family members who can perform real work. | Shifts income to lower tax brackets; may avoid FICA taxes for children under 18. |

| Leverage the QBI Deduction | Deduct up to 20% of qualified business income on your income tax return (different from SE tax). | Most pass-through businesses (sole props, partnerships, S corps) within income limits. | While it doesn’t reduce SE tax directly, it significantly lowers overall income tax burden. |

Advanced Strategy: S Corporation Tax Savings Example

Consider a sole proprietor with $100,000 in net profit:

As a Sole Proprietor: SE tax is due on ~$92,350 (92.35% of profit). SE Tax ≈ $14,130.

As an S Corp (with $50,000 reasonable salary): SE/employment tax is only due on the salary. Tax on $50,000 ≈ $7,650.

Savings: Approximately $6,480 in self-employment/payroll taxes, not counting additional income tax benefits from the QBI deduction on the remaining $50,000.

Introducing the Smart Calculate 1099 Taxes Self-Employed Calculator

While manual calculations are educational, a dedicated Calculate 1099 Taxes Self-Employed Calculator automates complexity and enables proactive planning. Our tool is designed to go beyond simple estimates.

What Makes Our Calculate 1099 Taxes Self Employed Calculator Different?

Unlike basic estimators, our integrated tool accounts for:

Deduction Optimization: Models the impact of common business deductions (home office, mileage, supplies).

Entity Comparison: Illustrates potential tax savings by comparing Sole Proprietor, LLC, and S Corporation status.

Quarterly Payment Planning: Calculates recommended quarterly estimated tax payments to avoid underpayment penalties.

Year-Over-Year Projection: Uses current (2025) and projected (2026) rates and thresholds for forward planning.

How to Use the Calculate 1099 Taxes Self Employed Calculator for Maximum Benefit

Gather Your Numbers: Have your year-to-date income and expense totals ready.

Input Business Details: Enter your net profit, filing status, and state of residence.

Apply Deductions: Input common deductible expenses (home office square footage, business miles, health insurance premiums).

Model Scenarios: Use the “S Corporation” toggle to see potential savings. Adjust your expected year-end income to plan Q4 estimated payments.

Save and Plan: Export your results to create a actionable tax strategy for the remainder of the year.

Essential Action Plan: From Calculate 1099 Taxes to Compliance

1. Make Your Quarterly Estimated Taxes Self Employed Payments

The U.S. tax system is “pay-as-you-go.” You generally must make quarterly estimated taxes self employed payments if you expect to owe at least $1,000 in tax for the year. Missing these can result in penalties. Use your calculator projections to determine these payments.

2. Maintain Impeccable Records

Accurate recordkeeping is non-negotiable. Digitize receipts, track mileage automatically with apps, and separate business from personal accounts. This is crucial for claiming deductions and surviving an audit.

3. Understand the Key Tax Forms

Schedule C (Form 1040): Calculates your business profit or loss (net earnings).

Schedule SE (Form 1040): Calculates taxes self-employed owed based on your net earnings.

Form 1040-ES: Used to calculate and pay quarterly estimated taxes self employed.

4. Know When to Get Professional Help

Consult a tax professional if:

Your net profit exceeds $100,000 (to explore S Corp election).

You are considering a major business structure change.

You have complex deductions, multiple income streams, or are facing an IRS notice.

Final Word: Knowledge is Your Greatest Tax Deduction

Understanding taxes self employed is your first line of defense. By combining accurate calculation with proactive reduction strategies, you can significantly improve your financial bottom line. Use the principles and strategies outlined here not just to calculate 1099 Taxes what you owe, but to strategically plan a less taxing financial future.

Disclaimer: This article is for informational purposes only and does not constitute legal or financial advice. Tax laws are complex and subject to change. Always consult with a qualified tax advisor or CPA regarding your specific situation.

Calculate 1099 Taxes Self Employed Mastery: Your Complete 2025-2026 FAQ & Action Guide

The Essential Calculate 1099 Taxes Self-Employed FAQs

Navigating self-employment taxes involves numerous questions. Here are detailed answers to the most critical and common concerns.

Payment & Filing Logistics

Q: How and when do I pay taxes self-employed?

You pay taxes self-employed through quarterly estimated tax payments using Form 1040-ES. The 2025 payment deadlines are:

April 15, 2025: For income Jan 1 – Mar 31

June 16, 2025: For income Apr 1 – May 31

September 15, 2025: For income Jun 1 – Aug 31

January 15, 2026: For income Sep 1 – Dec 31, 2025

Payments can be made electronically via IRS Direct Pay, EFTPS, or by mail with a voucher. Failure to pay enough through estimates may result in underpayment penalties.

Q: What happens if I also have a W-2 job?

Income from W-2 employment counts toward the Social Security wage base. Your employer withholds the employee portion of FICA tax (7.65%) from your wages. You must ensure your combined earnings from W-2 and self-employment do not exceed the annual Social Security cap ($176,100 for 2025) for the 12.4% portion. The 2.9% Medicare tax applies to all combined earnings without a cap.

Q: Can I deduct my home office? How does it affect my SE tax?

Yes, the home office deduction is a legitimate business expense that directly reduces your net earnings, thereby lowering your calculate 1099 Taxes self employed base. You can use the simplified method ($5 per square foot up to 300 sq ft) or the regular method (percentage of home expenses like mortgage interest, utilities, and insurance). The deduction must be for space used exclusively and regularly for business.

Common Challenges & Specific Situations

Q: I’m in my first year of self-employment. How do I avoid underpayment penalties?

The IRS generally requires you to pay at least 90% of your current year’s tax liability or 100% of your prior year’s tax liability (110% if your adjusted gross income was over $150,000) through withholding or estimated payments. In your first year, without a prior year’s tax return as a guide, aim to set aside 25-30% of your net income each month. Use our Calculate 1099 Taxes Self-Employed Calculator quarterly to project your earnings and adjust payments accordingly.

Q: Are business startup costs deductible?

Yes, but with specific rules. You can deduct up to $5,000 in startup costs and $5,000 in organizational costs in your first year of business. Expenses exceeding these amounts must be amortized (deducted in equal parts) over 15 years. These costs reduce your taxable business income.

Q: What if I operate as an LLC? How am I taxed?

A single-member LLC is treated as a “disregarded entity” by the IRS by default—your taxes are filed exactly as a sole proprietor using Schedule C. A multi-member LLC is taxed as a partnership by default. In both cases, you pay taxes self employed on the business profits. An LLC can also elect S-Corporation status with the IRS (by filing Form 2553) to potentially reduce taxes self-employment, as detailed in the strategies section.

Advanced Planning & Strategy

Q: How does the Qualified Business Income (QBI) Deduction interact with taxes self employed?

The QBI deduction is separate from self-employment tax. It allows you to deduct up to 20% of your qualified business income on your income tax return (Form 1040). It does not reduce your net earnings subject to the 15.3% self-employment tax. However, it is a powerful tool to reduce your overall income tax burden after calculating your SE tax. Self-Employment Tax Calculator is your companion.

Q: Is it worth becoming an S-Corporation to save on taxes?

It depends entirely on your net profit level. The S-Corp election makes financial sense when the tax savings on SE tax outweigh the added costs (e.g., payroll service fees, more complex tax filing, state franchise taxes). As a rule of thumb, if your annual net business profit consistently exceeds $50,000-$70,000, it’s worth discussing with a tax professional. The savings come from paying yourself a “reasonable salary” (subject to payroll taxes) and taking the remaining profit as distributions (not subject to SE tax).

When to Seek Professional Help: A Detailed Guide

While this guide and our calculator provide a strong foundation, certain situations necessitate professional advice. Consult a certified tax advisor or CPA if:

Your Net Profit Exceeds $100,000: The potential benefits and complexities of entity selection (S-Corp election), retirement planning, and advanced deductions require expert navigation.

You Are Considering an S-Corp Election: A professional will help determine a defensible “reasonable salary,” manage the payroll setup, and handle the required filings (Form 1120-S, Schedule K-1).

You Have Complex Deductions or Inventory: If you hold inventory, have significant equipment purchases (Section 179 deduction), or mixed-use assets (like a vehicle used for both business and personal purposes).

You Are Audited or Receive an IRS Notice: Never face the IRS alone. A tax professional, especially an Enrolled Agent (EA) or tax attorney, can represent you.

You Have International Elements: This includes foreign clients, overseas income, or foreign tax credits.

Building Your Tax Team: Who Does What?

Certified Public Accountant (CPA): Best for overall tax strategy, complex business structures, and audit representation.

Enrolled Agent (EA): Licensed by the IRS, specializing in taxation and excellent for tax preparation and audit defense.

Tax Attorney: Essential for legal disputes with the IRS, complex estate planning, or incorporation issues.

Your Year-End Tax Optimization Checklist (December 2025)

Use this actionable list in the final weeks of the tax year to maximize deductions and prepare for filing:

Review Year-to-Date Income & Expenses: Reconcile all bank and payment processor statements.

Maximize Retirement Contributions: Fund your Solo 401(k) or SEP IRA up to the limit to reduce taxable income.

Make Needed Equipment Purchases: Buy necessary business equipment before year-end to utilize the Section 179 deduction or bonus depreciation.

Defer Income/Accelerate Expenses: If cash flow allows, consider invoicing clients in early January and paying outstanding bills or stocking up on supplies in December.

Calculate Your Final Estimated Payment: Use your annual numbers to determine your January 15 payment.

Organize All Records: Digitize receipts, log mileage, and ensure your profit/loss statement is accurate.

Schedule a Meeting with Your Tax Professional: Do this in early January to plan your filing strategy, especially if you had a major change in income.

By mastering both the strategic knowledge in this guide and the tactical steps in this checklist, you transform tax season from a source of stress into an opportunity for financial optimization. Remember, proactive management of your Calculate 1099 Taxes self-employed taxes is one of the most powerful business skills you can develop.