Calculate Car Payment : Master Your Car Debt

Our advanced Calculate Car Payment calculator empowers you to create a personalized debt elimination strategy, showing exactly how small changes can lead to massive savings and get you out of debt years faster.

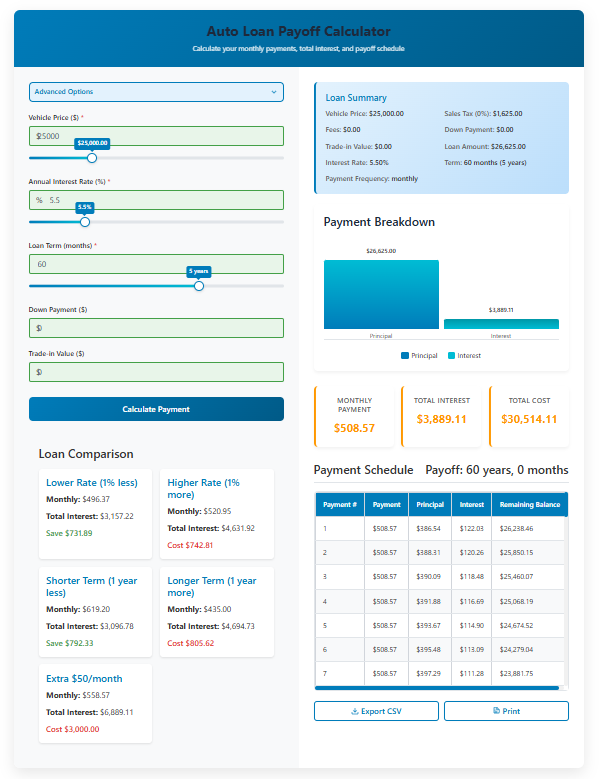

Auto Loan Payoff Calculator

Loan Comparison

Loan Summary

Payment Breakdown

Monthly Payment

Total Interest

Total Cost

Payment Schedule

| Payment # | Payment | Principal | Interest | Remaining Balance |

|---|

Calculate Car Payment : Master Your Car Debt

What if you could discover an extra $2,500 in your budget without getting a raise? For the average American with a car loan, this isn’t a fantasy—it’s the potential interest savings from strategically managing their auto debt. With U.S. auto loan debt surpassing $1.6 trillion, understanding how to accelerate your payoff isn’t just smart; it’s essential financial self-defense.

Our advanced Calculator to Calculate Car Payment empowers you to create a personalized debt elimination strategy, showing exactly how small changes can lead to massive savings and get you out of debt years faster.

Why You Need to Calculate Car Payment

An auto loan payoff calculator to Calculate Car Payment is more than just a number cruncher—it’s a financial planning tool that reveals the true cost of your loan and the power of strategic prepayments. Most borrowers focus only on their monthly payment, unaware of how much they’re truly paying in interest over the life of the loan.

Key benefits of using our calculator to calculate car payment :

Visualize Total Interest Costs: See exactly how much your loan truly costs beyond the principal

Test Different Payoff Strategies: Experiment with extra payments without financial risk

Create a Realistic Timeline: Set achievable debt-free goals based on your budget

Build Equity Faster: Understand how accelerated payments increase your vehicle equity

Motivate Your Debt-Free Journey: Watching your payoff date move closer provides powerful psychological reinforcement

How to Use Our Calculator to Calculate Payment

Our calculator to calculate car payment simplifies complex amortization math into an intuitive, visual experience. Here’s how to get the most accurate results:

Step 1: Input Your Current Loan Details

Loan Amount: Enter your remaining principal balance. This is the amount you still owe, not necessarily your original loan amount.

Annual Interest Rate (APR): Input your loan’s annual percentage rate. This determines how much interest accrues each month.

Loan Term (months): Specify how many months remain on your loan term.

Step 2: Add Your Extra Payment Strategy to calculate car payment

Additional Monthly Payment: Even small amounts like $25-$100 monthly can dramatically reduce your payoff timeline.

One-Time Lump Sum Payment: Plan for using tax refunds, bonuses, or other windfalls to make a significant dent in your principal.

Step 3: Analyze Your Results

Our calculator to calculate car payment generates three key insights:

New Payoff Date: See exactly when you’ll be debt-free

Total Interest Saved: Discover how much money stays in your pocket

Time Saved: Learn how many months or years you’ve shaved off your loan

The Math Behind to Calculate Car Payment Savings: Real Examples

Let’s examine how different strategies play out with actual numbers:

Example 1: The Power of Small Consistent Payments

Original Loan:

Loan Amount: $25,000

Interest Rate: 6%

Term: 60 months

Monthly Payment: $483

Total Interest Paid: $3,967

With $50 Extra Monthly:

New Monthly Payment: $533

Payoff Timeline: 53 months (7 months early)

Total Interest Paid: $3,384

Interest Savings: $583

Example 2: Strategic Lump Sum Payment to calculate Car Payment

Same Original Loan Parameters

With $1,000 One-Time Payment:

Payoff Timeline: 56 months (4 months early)

Total Interest Paid: $3,546

Interest Savings: $421

Combined Strategy ($50 monthly + $1,000 lump sum):

Payoff Timeline: 49 months (11 months early)

Total Interest Paid: $3,064

Total Interest Savings: $903

Advanced Calculate Car Payment Strategies You Can Model

1. The Debt Avalanche Method

If you have multiple debts, our calculator to calculate car payment helps implement the debt avalanche approach—focusing extra payments on your highest-interest debt first while making minimum payments on others. For most consumers, auto loans represent a middle-ground interest rate, typically higher than mortgage rates but lower than credit card rates.

2. Biweekly Payment Conversion

Instead of monthly payments, pay half your payment every two weeks. This results in 26 half-payments annually, equivalent to 13 full monthly payments. Our calculator to calculate car payment can show how this simple change accelerates your payoff.

3. Refinancing Analysis to calculate car payment payoff

If interest rates have dropped since you obtained your loan, use our calculator to calculate car payment payoff to compare your current payoff timeline with a potential refinance scenario. Factor in any refinancing fees to determine true savings.

4. The "Round-Up" Method

Round your payment up to the nearest $25 or $50. This painless approach builds extra payments into your budget without significant lifestyle impact.

Understanding Car Payment payoff Amortization

Auto loans use simple interest amortization, meaning each payment covers that month’s interest first, with the remainder reducing your principal. This is why:

Early payments are interest-heavy

Principal reduction accelerates over time

Extra payments early in the loan term have the greatest impact

Our calculator to calculate car Payment payoff calculator’s amortization schedule shows exactly how each payment splits between interest and principal, providing transparency into your loan’s structure.

Common Auto Loan Payoff Questions

Will my lender allow extra payments?

Most auto lenders accept extra payments, but you may need to specify that additional amounts should apply to principal, not future payments. Always verify with your lender.

Are there prepayment penalties? calculate car payment payoff

Some loans include prepayment penalties, though they’re increasingly rare. Check your loan agreement before accelerating payments.

Should I pay off my auto loan early or invest?

This depends on your interest rate and investment returns. As a general rule:

Rates above 5-6%: Prioritize payoff

Rates below 4%: Consider investing extra money instead

How does loan payoff affect my credit score?

Initially, you might see a small dip from closing an account, but long-term, reducing your debt-to-income ratio and demonstrating responsible payment history benefits your credit health.

Take Control of Your Auto Debt Today

With our Calculator to Calculate Car Payment Payoff

The path to becoming car payment-free begins with understanding your options. Our Calculator to Calculate Car Payment Payoff transforms abstract financial concepts into actionable, personalized plans.

Ready to start saving?

Use our calculator to calculate car payment payoff calculator above to input your loan details

Experiment with different payment scenarios

Choose a strategy that fits your budget

Contact your lender to implement your plan

Enjoy watching your debt disappear faster than you imagined

Every extra dollar paid toward principal represents money that stays in your pocket instead of going to the lender. The journey to financial freedom begins with a single calculated decision.