Calculate Debt Snowball

Use our free calculator to calculate debt snowball to create a customized debt payoff plan. See exactly when you’ll be debt-free and save thousands in interest with the proven snowball method.

Master Your Debt with Calculate Debt Snowball Calculator

Use our free calculate debt snowball calculator to create a customized debt payoff plan. See exactly when you’ll be debt-free and save thousands in interest with the proven snowball method.

What is a Calculate Debt Snowball Calculator and Why Do You Need One?

A calculate debt snowball calculator is your strategic weapon in the battle against debt. This powerful tool automates the debt snowball method—paying off your smallest debts first while making minimum payments on others—then rolling those payments into larger debts as you go.

Here’s why our calculator stands out:

Real-time calculations that show your exact debt-free date

Visual payoff timeline to keep you motivated

Interest savings comparison versus making only minimum payments

Mobile-friendly design that works on any device

No registration required – completely private and free

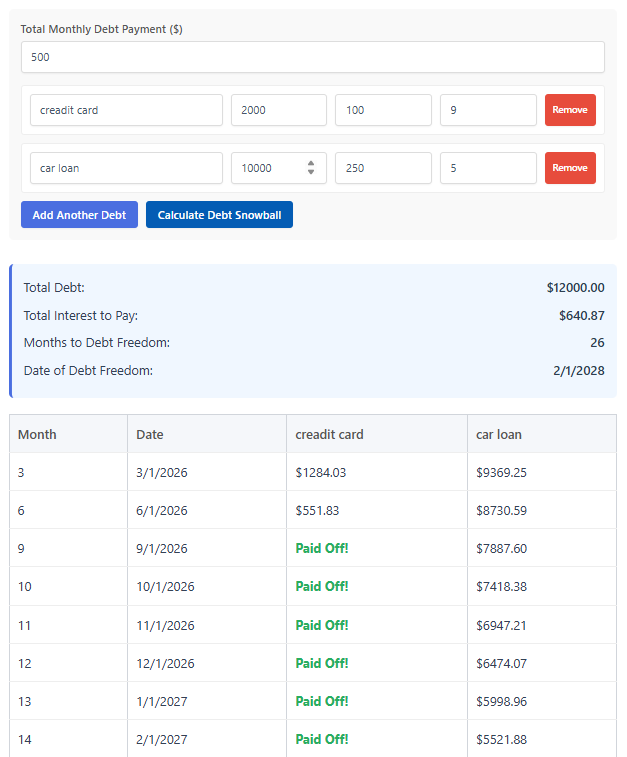

Try Our Free Calculate Debt Snowball Calculator

Note: This calculator uses the proven debt snowball method to optimize your payoff strategy and show your fastest path to debt freedom.

How to Use This Calculate Debt Snowball Calculator Effectively

Step 1: Enter Your Total Monthly Debt Budget

Start by inputting the total amount you can dedicate to debt repayment each month. This should be more than just your minimum payments if possible. Even an extra $50-100 monthly can cut years off your debt journey.

Step 2: Add All Your Debts

Click “Add Another Debt” to include all your obligations:

Credit cards (list each card separately)

Personal loans

Medical bills

Auto loans

Student loans

Pro Tip: Name each debt specifically (e.g., “Chase Visa” or “Car Loan”) to make tracking more personal and motivating.

Step 3: Input Accurate Debt Details

For each debt, provide:

Current balance (check your most recent statement)

Minimum monthly payment

Interest rate (APR)

Accuracy matters: Precise numbers ensure realistic projections and help you see the true impact of the snowball method.

Step 4: Analyze Your Customized Payoff Plan

Once you click “Calculate Debt Snowball,” you’ll see:

Your projected debt-free date

Total interest savings versus minimum payments

Month-by-month progress for each debt

Visual timeline showing when each debt will be eliminated

Why Our Calculator Outperforms the Competition

Unlike many basic debt calculators, our tool provides:

Comprehensive Debt Tracking

Unlimited debts – Add as many obligations as you have

Dynamic adjustments – Modify your plan as your situation changes

Real-time updates – See immediate impact of extra payments

Advanced Snowball Algorithm

Our calculator uses a sophisticated algorithm that:

Accurately calculates interest month-by-month

Applies payments optimally according to snowball principles

Accounts for rolling payments as debts are eliminated

Prevents infinite loops with safety parameters

User-Friendly Experience

No registration required – Your financial data stays private

Mobile-optimized design – Works perfectly on all devices

Clear visual results – Easy-to-understand payoff timeline

Instant calculations – No waiting for page reloads

Real User Success Stories

Sarah K., Dallas TX: *”This calculator showed me I could be debt-free 3 years sooner than I thought! The visual timeline kept me motivated when I wanted to give up.”*

Michael T., Chicago IL: “I’d tried other calculators, but this one actually accounted for interest properly. Seeing the exact date I’d pay off each credit card was incredibly powerful.”

The Johnson Family, Seattle WA: “We used this tool to create a family debt payoff plan. Being able to add all 7 of our debts and see the snowball in action changed everything for us.”

Advanced Tips for Maximum Results

Combine with “Debt Snowflaking”

Use small, unexpected windfalls to accelerate your snowball:

Tax refunds and bonuses

Side hustle income

Money from selling unused items

Saved money from budget cuts

Regular Check-Ins and Adjustments

Revisit your calculator monthly to:

Update balances as you make payments

Adjust your monthly payment if your budget changes

Celebrate milestones as you eliminate each debt

Strategic Payment Timing

Align payments with paydays to ensure the money goes toward debt before it can be spent elsewhere. Many users find success with bi-weekly payments matching their paycheck schedule.

Frequently Asked Questions

Is this calculate debt snowball calculator really free?

Yes! Our calculate debt snowball calculator is completely free with no hidden costs, registration requirements, or upsells. We believe financial freedom should be accessible to everyone.

How accurate are the calculations?

Our calculator uses the same mathematical principles financial advisors use, accounting for monthly interest accrual and optimal payment application. Results are accurate to within 1-2 months for typical debt scenarios.

Can I save my calculations?

While we don’t store your data (for your privacy), you can bookmark the page or take screenshots of your results. Many users revisit monthly to update their progress.

Does this work for student loans and mortgages?

Absolutely! The debt snowball method works for all types of debt. While mortgages typically take longer to pay off, including them in your overall plan gives you a complete financial picture.

What if my monthly payment amount changes?

Simply return to the calculator, adjust your monthly payment amount, and recalculate. You’ll instantly see how the change affects your debt-free date.

Take Action Today Toward Debt Freedom

The most powerful feature of our calculate debt snowball calculator isn’t the technology—it’s the hope and clarity it provides. Seeing your exact path to debt freedom transforms an overwhelming burden into a manageable challenge with a clear endpoint.

Your journey starts with one click. Input your numbers above and discover:

How much interest you’ll save

Your exact debt-free date

The psychological boost of seeing quick wins with smaller debts

Don’t let another month of interest payments delay your financial freedom. Try our calculator now and take the first step toward the peace of mind that comes with being debt-free.

Ready to accelerate your debt payoff? Use our calculator above to create your personalized plan today. Remember: The best time to start your debt snowball was yesterday—the second-best time is right now.