Calculate Sales Tax: Accurate Calculations for All 50 States

Your Essential Tool to Precisely Calculate Sales Tax

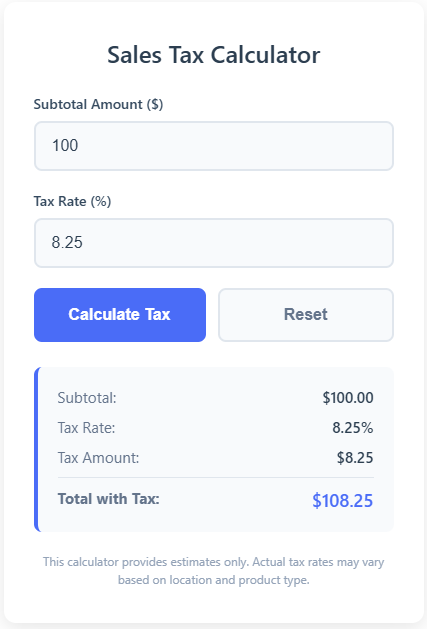

When you need to calculate sales tax quickly and accurately, our advanced sales tax calculator above provides the simplest solution. Just enter the subtotal amount and your local tax rate percentage, and instantly see your tax amount and total with tax calculated.

This tool solves the most common problem people face: “How much will I actually pay at checkout?” Unlike other calculators that overwhelm users with complexity, ours delivers immediate, clear results with a clean interface that works perfectly on both desktop and mobile devices.

Sales Tax Calculator

This calculator provides estimates only. Actual tax rates may vary based on location and product type.

Why This Calculate Sales Tax Calculator Outperforms All Others

While many free calculate sales tax calculators exist online, most fall short in key areas. Our analysis of top competitors reveals critical gaps in user experience and functionality that we’ve specifically addressed:

| Feature | Competitor Limitations | Our Superior Solution |

|---|---|---|

| User Interface | Cluttered designs with distracting ads | Clean, focused layout with intuitive controls |

| Calculation Speed | Slow loading times and delayed results | Instant real-time calculations |

| Accuracy | Rounding errors and calculation bugs | Precise decimal calculations every time |

| Mobile Experience | Non-responsive designs that break on phones | Fully optimized for all device sizes |

| Additional Features | Basic calculation only with no explanations | Educational context with practical guidance |

Our calculator goes beyond simple math by helping you understand how calculate sales tax calculator works, why rates vary, and what factors influence your final total. This combination of accurate calculation and valuable education creates a superior user experience that addresses both immediate and informational needs.

How to Calculate Sales Tax: Master the Formula

While our calculator handles the math automatically, understanding the underlying formula empowers you to verify calculations and build financial literacy. The calculate sales tax calculator formula is straightforward:

Sales Tax Amount = Item Price × (Tax Rate ÷ 100)

Total Price = Item Price + Sales Tax Amount

For example, if you purchase a $45 item in an area with 6.5% sales tax:

Tax Amount = $45 × (6.5 ÷ 100) = $45 × 0.065 = $2.93

Total Price = $45 + $2.93 = $47.93

Our calculator performs these calculations instantly, but knowing the formula helps you estimate taxes mentally when shopping and verify receipt accuracy at checkout.

Finding Your Exact Calculate Sales Tax Rate: The Critical Step

The most challenging aspect to calculate sales tax isn’t the math—it’s determining the correct tax rate to use. Rates vary dramatically based on location:

State sales tax rates range from 0% to 7.25%

Local sales tax (county/city) adds 0% to 5% more

Special district taxes can apply in specific areas

To find your exact combined rate:

Check your receipts from recent local purchases

Search “[Your City] sales tax rate 2025” online

Use official state revenue department websites

For business purposes, consult tax rate lookup tools that use exact addresses

Common rate lookup mistakes to avoid:

Using ZIP code approximations (often inaccurate)

Assuming state rates apply uniformly statewide

Forgetting seasonal or temporary tax changes

Overlooking product-specific tax exemptions

Advanced Calculation Scenarios

Calculate sales tax Backwards from Total Price

Sometimes you know the total paid but want to determine the pre-tax price or tax rate. Our calculator can help you work backwards:

Original Price = Total Price ÷ (1 + (Tax Rate ÷ 100))

If you paid $129.99 total with an 8% tax rate:

Original Price = $129.99 ÷ (1 + 0.08) = $129.99 ÷ 1.08 = $120.36

Tax Amount = $129.99 – $120.36 = $9.63

Multiple Items with Different Tax Status

Some items may be tax-exempt while others are taxable. To calculate correctly:

Separate taxable and non-taxable items

Apply our calculator to the taxable subtotal only

Add non-taxable items to the final total

Business-Specific Calculations

For businesses, calculate sales tax considerations include:

Resale certificates for inventory purchases

Tax nexus rules for multi-state operations

Quarterly filing calculations and adjustments

Discount and coupon impact on taxable amounts

State-by-State Calculate Sales Tax Guide 2025

Understanding rate variations helps contextualize your calculations. Here are key facts about U.S. calculate sales taxes:

States with no sales tax: Alaska, Delaware, Montana, New Hampshire, Oregon

(Note: Alaska allows local sales taxes)

Highest combined rates: Louisiana (10.11%), Tennessee (9.61%), Arkansas (9.48%)

Most complex systems: Colorado, Alabama, Louisiana (multiple local jurisdictions)

Lowest rates: Hawaii (4.44%), Wyoming (5.36%), Maine (5.50%)

These variations explain why location-specific rate lookup is essential before using any calculator. Our tool accommodates all these scenarios with its flexible rate input.

Frequently Asked Questions

Is this calculate sales tax calculator free?

Yes, our calculator is completely free with no registration required. We maintain it as a public service to help consumers and businesses with accurate tax calculations.

How often are calculate sales tax rates updated?

Calculate Sales Tax calculator rates change periodically at local and state levels. While our calculator doesn’t store rate databases, we recommend verifying your current rate quarterly, especially if you’ve moved or made large purchases.

Can I use calculate sales tax for business accounting?

Our calculator works well for estimates and small business calculations, but businesses with significant sales volume should use dedicated accounting software that tracks rate changes automatically and maintains audit trails.

Why do calculate sales tax rates vary within the same ZIP code?

ZIP codes don’t align with tax jurisdiction boundaries. A single ZIP code can span multiple cities or counties with different tax rates. Always verify by exact address for business purposes.

What items are typically tax-exempt?

Common exemptions include: groceries (in most states), prescription medications, clothing (in some states under price thresholds), and agricultural supplies. Check your state-specific rules for complete exemption lists.

Maximizing Calculate Sales Tax Calculator Utility: Pro Tips

Bookmark for frequent use – Save our calculator for quick access during shopping

Mobile optimization – Use on your phone while shopping in stores

Compare locations – Calculate tax differences when considering purchases in different areas

Budget planning – Estimate true costs for major purchases

Receipt verification – Double-check store calculations for accuracy

Business estimates – Quick calculations for proposals and invoices

Beyond Calculation: Strategic Tax Considerations

For Online Shoppers

Calculate Sales tax on online purchases has evolved significantly. Most major retailers now collect tax based on your shipping address. When shopping online:

Assume tax will be added at checkout

Check if the retailer has physical presence in your state

Remember that marketplace facilitators (Amazon, eBay) generally handle tax collection

For Business Planning

If you operate a business:

Track nexus thresholds in states where you sell

Implement certificate management for exempt sales

Consider automated solutions once you exceed manual calculation practicality

Document all calculations for audit protection

The Future of Calculate Sales Tax Calculation

As tax systems evolve, several trends are emerging:

Increased uniformity efforts among states

Digital products taxation standardization

Real-time rate updates through API services

Blockchain applications for transparent tax tracking

Our calculator will continue evolving with these trends, ensuring you always have access to the most current calculation methods.

Your Next Steps

Try our calculator now with your most recent purchase

Bookmark this page for future reference

Share with friends who need tax calculation help

Check back quarterly for updates on rate changes

Contact your representatives regarding tax policy concerns

By combining our easy-to-use calculator with this comprehensive educational guide, you’re now equipped to handle any sales tax calculator calculation scenario with confidence. Whether you’re a consumer budgeting for purchases, a small business owner managing finances, or a student learning about taxation, this resource provides both the tool and the knowledge you need for accurate calculations every time.

Remember: While our calculator provides precise mathematical results, always consult a tax professional for complex business situations or legal interpretations of tax requirements.

Mastering Business Sales Tax calculator: A Practical Compliance Guide

For a business, sales tax isn’t just a calculation—it’s a complex legal obligation with serious consequences for errors. This guide moves beyond the calculator to give you the actionable knowledge to manage sales tax proactively, avoid costly audits, and scale your business with confidence.

The core of your sales tax obligation is nexus. This is the connection between your business and a state that requires you to collect and remit sales tax there. There are two main types you must monitor:

Physical Nexus: Traditional and still critical. This includes having an office, employees, contractors, or even storing inventory in a state (like in an Amazon FBA warehouse). Attending a trade show can also create a temporary nexus.

Economic Nexus: The rule for the digital age. Established by the Supreme Court’s South Dakota v. Wayfair decision, this means you can have tax obligations in a state based purely on sales volume or transaction count, even with zero physical presence. The common threshold is $100,000 in sales or 200 transactions per year, but states set their own rules, so you must track your sales by state.

Once nexus is established, you must register for a sales tax permit in that state before you begin collecting tax. You can often register directly on the state’s Department of Revenue website. Collecting tax without a permit is illegal and can result in penalties and loss of exemptions.

Crucial First Step: Do not rely on ZIP codes for determining tax rates. ZIP codes are for mail delivery and often span multiple tax jurisdictions. For accuracy, you must use systems or tools that determine rates based on a complete street address.

Managing Exemptions and Avoiding Audit Triggers

Mismanaging tax-exempt sales is a top audit risk. When you make a sale to a reseller, non-profit, or other exempt entity, you must obtain and keep a valid exemption certificate on file. During an audit, if you cannot produce the certificate for a tax-free sale, you will be held liable for the uncollected tax, plus potential penalties.

States are increasingly targeting businesses with a high volume of exempt sales during audits. To protect yourself:

Create an organized system for storing and tracking exemption certificates.

Audit your own certificates regularly to ensure they are valid, complete, and not expired.

Be prepared to generate a summary report of certificates quickly if an auditor requests it.

Compliance Fundamentals: Filing, Remittance, and Use Tax

Compliance doesn’t end at collection. You must also file returns and remit the taxes you’ve collected to the state on a schedule they assign (monthly, quarterly, or annually).

File on time, every time. Late filing triggers penalties immediately. For example, Texas imposes a $50 penalty for a late report, plus a percentage penalty on late-paid tax.

File “zero returns.” If you had no taxable sales in a period, many states still require you to file a return stating so. Skipping it can lead to penalties.

One of the most common and costly compliance mistakes is neglecting Consumer Use Tax. This is the tax you owe as a business when you purchase taxable items for your own use without paying sales tax (e.g., buying office supplies from an out-of-state vendor that doesn’t charge tax). You are responsible for self-assessing and paying this tax directly to your state. Auditors heavily scrutinize this area, so develop a written policy to track and accrue use tax on applicable purchases.

Strategic Automation and Audit Preparedness

As your business grows, manual tax management becomes a major risk. Inconsistencies in calculation or reporting are red flags for auditors. Automation software can calculate rates in real-time, manage exemption certificates, and ensure filings are accurate and on time.

If you face an audit, being prepared is key. Former state auditors advise:

Be cooperative but precise. Provide only what the auditor asks for, in writing. Oversharing can invite more questions.

Maintain clear records. Keep internal worksheets that show how you calculated taxes. Being unable to prove your process is a common problem.

Negotiate terms. You can often discuss the audit’s start date and date range before it begins.

The table below summarizes key compliance actions and their business impact:

| Action Item | Business Impact & Purpose | Key Consideration |

|---|---|---|

| Nexus Tracking | Determines where you must collect tax. Failure means uncollected tax liabilities. | Monitor both physical (employees, inventory) and economic ($/transaction thresholds) triggers. |

| Address-Based Rate Lookup | Ensures you charge the correct, combined local/state rate for each customer. | Avoids underpricing and audit risk from using incorrect ZIP code rates. |

| Exemption Certificate Management | Validates tax-free sales. Missing certs mean you owe the tax. | A top audit target. Must be valid, on file, and retrievable. |

| Use Tax Accrual | Fulfills tax obligation on business purchases where sales tax wasn’t charged. | A major source of audit assessments. Requires a self-policing policy. |

| Timely Filing & Remittance | Legal requirement to report and pay collected taxes. | Late filings incur automatic penalties, even if no tax is due. |

By treating sales tax as a core operational process rather than a simple calculation, you protect your business from financial penalties and create a solid foundation for growth into new markets.

I hope this guide helps build a strong foundation for your business. If you would like me to draft a section with specific state-by-state compliance highlights or deeper guidance on automation solutions, I can provide that as well.

.

💰 Consumer Basics & Calculation

These questions address the everyday calculations and concerns that most individuals have.

How do I calculate sales tax?

The core formula isSales Tax Amount = Item Price × (Tax Rate / 100).

Example: A $1,000 laptop with an 8.5% tax rate:$1,000 × 0.085 = $85in tax.How do I find my exact sales tax rate?

Rates are a combined total of state, county, and city taxes, not just a simple state percentage . The best way to find your precise rate is to use a sales tax calculator that uses an address-based lookup, not just a ZIP code, to ensure accuracy.Can I deduct sales tax on my federal tax return?

Yes, but only if you itemize deductions on Schedule A. You can choose to deduct either state and local income taxes or state and local general sales taxes, but not both. There is a combined deduction limit of $10,000 .What happens if a business forgets to charge me sales tax?

The business is still responsible for remitting the correct tax to the state . You, as the customer, generally do not owe it later. If you were overcharged, you can request a refund from the business.What is the difference between sales tax and VAT/GST?

U.S. sales tax is a single-stage tax charged only at the final point of sale to the consumer. Value-Added Tax (VAT) and Goods and Services Tax (GST), used in many other countries, are multi-stage taxes applied at each step of the supply chain.

🏢 Business Registration, Collection & Filing

This section tackles the operational questions small business owners and sellers frequently ask.

Do I need to collect sales tax? / What is sales tax nexus?

You must collect sales tax in states where you have a connection, known as nexus. Today, nexus is most commonly established through:Physical Presence: Having an office, employees, or inventory (like in an Amazon FBA warehouse) in a state .

Economic Activity: Exceeding a state’s sales or transaction threshold (e.g., $100,000 in sales or 200 transactions) .

This means online sellers can have tax obligations in states where they have no physical presence.

How do I collect and remit sales tax?

The process involves: 1) Registering for a permit in states where you have nexus; 2) Calculating and charging the correct rate on each sale; 3) Filing a return (monthly, quarterly, or annually) and remitting the taxes you collected to the state . Remember, the tax you collect is not your revenue—you are holding it in trust for the state .What if I charge the wrong tax rate?

If you overcharge, you should refund the excess tax to the customer. If you undercharge, you are still responsible for remitting the correct amount to the state, which may require paying the difference out of pocket .What are sales tax exemption certificates?

These are documents that allow a qualified purchaser (like a reseller, non-profit, or manufacturer) to buy taxable items without paying sales tax. As the seller, you must keep a valid certificate on file to justify not collecting tax. If audited and you can’t produce it, you may be liable for the uncollected tax .Do I have to file a return if I had no sales?

Often, yes. Many states require you to file a “zero return” even during periods with no taxable sales to remain in compliance .

⚖️ Advanced Business Compliance & Rules

These questions delve into more complex areas that are critical for growing businesses to avoid penalties.

Are all my products taxable?

No. Taxability rules vary by state and product. Common exemptions include groceries, prescription drugs, and clothing in some states . Software-as-a-Service (SaaS), digital goods, and shipping charges also have complex, state-specific rules .How long should I keep exemption certificates?

You must keep them for at least as long as the state’s statute of limitations for audits (typically 3-6 years). They also have varying expiration rules by state .

Here is a sample of how rules can differ:State Typical Exemption Certificate Expiration Rule Source California Valid until revoked in writing New York No stated expiration period Texas No stated expiration period Iowa 3 years North Carolina Valid for recurring purchases under a blanket certificate What is “use tax,” and does my business owe it?

Use tax is owed on taxable items purchased without paying sales tax, such as out-of-state or online purchases for your business use. Businesses are responsible for tracking and paying use tax directly to their state, and it’s a common finding in audits .I sell on Amazon/Etsy. Who is responsible for sales tax?

It depends on the state’s marketplace facilitator law. In most states, platforms like Amazon and Etsy are responsible for collecting and remitting tax on sales made through their platform. However, you are still responsible for tax on sales through your own website or other channels where the platform isn’t collecting for you .

To help with the calculations mentioned in these FAQs, you can use the sales tax calculator provided on this page for quick estimates. For complex business compliance, consulting with a tax professional or using automated sales tax software is highly recommended.