Calculate Interest on a loan

Our advanced calculate interest on a loan calculator provides instant, accurate calculations that help you make informed financial decisions. Unlike basic calculators that just show monthly payments, ours gives you a complete picture of your loan with visual breakdowns and real-time updates.

Why This Is The Most User-Friendly calculate interest on a loan Calculator Online

What makes our calculator superior:

Real-time visual payment breakdown showing principal vs. interest

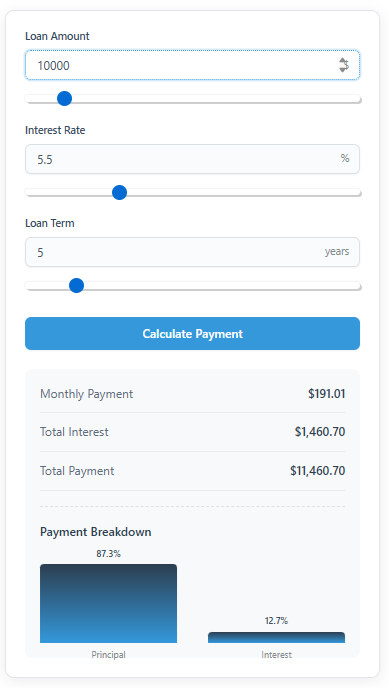

Dual input controls – use sliders or type exact numbers

Mobile-optimized design that works perfectly on all devices

No registration required – completely free with no email required

Instant amortization insights to understand your payment structure

How to Use Our calculate interest on a loan Calculator in 3 Simple Steps

Step 1: Enter Your Loan Details

Loan Amount: The total amount you want to borrow ($100 – $1,000,000)

Interest Rate: Your expected annual percentage rate (0.1% – 30%)

Loan Term: The repayment period in years (1-30 years)

Step 2: Adjust with Sliders or Inputs

Use the sliders for quick adjustments or type exact numbers in the input fields. Watch how changes instantly update your results.

Step 3: Analyze Your Complete Payment Picture

See your monthly payment, total interest cost, and visual payment breakdown all in one view.

Understanding Your calculate interest on a loan Calculator Results

Monthly Payment: What You’ll Pay Each Month

This is your fixed monthly amount that includes both principal and interest. The calculator uses the standard amortization formula to ensure accuracy.

Total Interest: The True Cost of Borrowing

This shows how much extra you’ll pay beyond the original loan amount. Even small rate changes can significantly impact this number.

Payment Breakdown: See Where Your Money Goes

The visual chart shows what percentage of your payment goes toward the principal (the actual loan amount) versus interest (the cost of borrowing).

Real-World calculate interest on a loan Calculator Scenarios: See How Numbers Change

Example 1: $25,000 Auto Loan

5 years at 6.5%: $489/month, total interest $4,340

3 years at 6.5%: $766/month, total interest $2,576

Savings: Shorter term saves $1,764 in interest

Example 2: $300,000 Mortgage

30 years at 7%: $1,996/month, total interest $418,527

15 years at 6.5%: $2,613/month, total interest $170,308

Savings: 15-year term saves $248,219 in interest

Example 3: $10,000 Personal Loan

5 years at 12%: $222/month, total interest $3,322

3 years at 12%: $332/month, total interest $1,955

Savings: Shorter term saves $1,367 in interest

The Power of Visual Payment Breakdown

Our unique chart visualization helps you understand:

Principal Percentage: How much of each payment reduces your actual debt

Interest Percentage: How much goes to the lender as borrowing cost

Long-term Impact: How these ratios change over the loan life

Early in the loan: More of your payment goes toward interest

Later in the loan: More goes toward reducing principal

calculate interest on a loan Calculator Formula: How It Works

The simple loan calculator uses the standard amortization formula:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

M = Monthly payment

P = Principal loan amount

i = Monthly interest rate (annual rate ÷ 12)

n = Total number of payments (loan term in years × 12)

This ensures accurate, professional-grade calculations you can trust for financial planning.

Tips for Getting the Most Accurate Results

Check Current Rates: Research current average rates for your loan type

Consider Your Credit: Higher credit scores typically get better rates

Factor in Fees: Some loans have origination fees affecting total cost

Compare Lenders: Get multiple quotes for the best deal

Frequently Asked Questions for Simple Loan Calculator

What's the difference between interest rate and APR?

Interest rate is the cost of borrowing the principal amount. APR (Annual Percentage Rate) includes interest plus other loan fees. Always compare APRs when shopping for loans.

How does the payment breakdown change over time?

Early in the loan, most of your payment goes toward interest. As the principal decreases, more of each payment goes toward reducing the actual debt.

Can I use this simple loan calculator for different loan types?

Yes! Our calculator works for:

Mortgages (home loans)

Auto loans (car financing)

Personal loans (debt consolidation, home improvement)

Student loans (education financing)

Business loans (small business financing)

Why does a shorter loan term save money?

Shorter terms have higher monthly payments but significantly less total interest because you pay off the principal faster, reducing interest accumulation.

How accurate is this calculate interest on a loan calculator?

Our calculate interest on a loan calculator uses professional financial formulas identical to those used by banks and lenders. Results are accurate for fixed-rate loans with consistent payments.

Advanced Features of Our calculate interest on a loan Calculator

Real-Time Updates

Change any input and see results update instantly without clicking “calculate”

Mobile Optimization

Perfectly responsive design works on smartphones, tablets, and desktops

Visual Data Presentation

Easy-to-understand charts make complex financial data accessible

No Hidden Costs

Completely free – no subscriptions, no registrations, no limitations

Take Control of Your Financial Future Today

Now that you understand how loans work, use our calculator to:

Test different scenarios before visiting lenders

Understand the true cost of borrowing money

Make informed decisions about loan terms and amounts

Plan your budget with accurate payment expectations

Remember: The best loan is one you fully understand. Use our calculator multiple times with different numbers to find the optimal loan structure for your situation.

Bookmark this page for future reference! Our loan calculator is regularly maintained and updated to ensure accuracy. Share it with friends and family who are considering loans.