How much is Capital Gains Tax

Don’t let surprise taxes erode your investment returns. Before you sell stocks, crypto, or real estate, it’s essential to know your exact take-home profit. Our intuitive how much is Capital Gains Tax Calculator provides a clear forecast of your estimated tax bill in seconds. See how long-term vs. short-term rates, your tax bracket, and potential deductions affect your bottom line. Plan smarter, keep more of your gains, and avoid costly miscalculations.

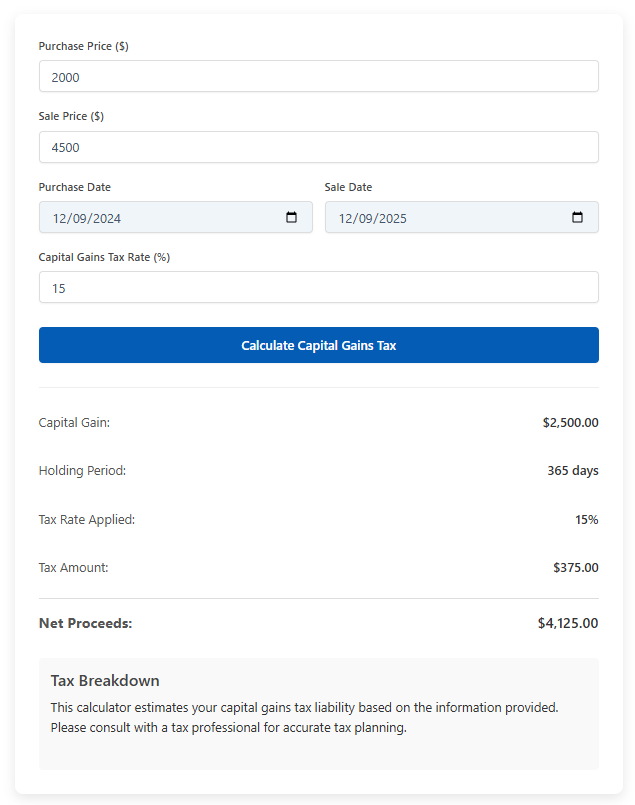

Tax Breakdown

This calculator estimates your capital gains tax liability based on the information provided. Please consult with a tax professional for accurate tax planning.

How much is Capital Gains Tax: Your Guide to Accurate 2025 Estimates & Smart Strategies

Navigating capital gains taxes can significantly impact your investment returns. Whether you’re selling stocks, real estate, or business assets, understanding your potential tax liability is the key to maximizing your profits. This comprehensive guide, paired with a powerful how much is capital gains tax calculator, provides everything you need to make informed decisions and explore legal strategies to minimize your tax burden.

Key Insight: The difference between short-term and long-term capital gains can be substantial. For a single filer with a $50,000 salary and a $15,000 investment profit, holding the asset for over one year could reduce the federal tax on that gain from 22% to 15%, saving over $1,000.

2024 & 2025 Capital Gains Tax Calculator Rates

2024 & 2025 Capital Gains Tax Calculator Rates

How much is capital gains tax rate is determined by two primary factors: how long you held the asset and your taxable income and filing status. The rates below are crucial for accurate estimations.

Long-Term Capital Gains Tax Calculator Rates (Assets Held >1 Year)

Long-term gains benefit from significantly lower, preferential tax rates.

| Filing Status | 0% Rate Bracket (2024) | 0% Rate Bracket (2025) | 15% Rate Bracket (2024) | 15% Rate Bracket (2025) | 20% Rate Bracket (2024) | 20% Rate Bracket (2025) |

|---|---|---|---|---|---|---|

| Single | Up to $47,025 | Up to $48,350 | $47,026 – $518,900 | $48,351 – $533,400 | Over $518,900 | Over $533,400 |

| Married, Filing Jointly | Up to $94,050 | Up to $96,700 | $94,051 – $583,750 | $96,701 – $600,050 | Over $583,750 | Over $600,050 |

| Head of Household | Up to $63,000 | Up to $64,750 | $63,001 – $551,350 | $64,751 – $566,700 | Over $551,350 | Over $566,700 |

Rates apply to the 2024 tax year (filed in 2025) and the 2025 tax year (filed in 2026).

Short-Term Capital Gains Tax Calculator Rates (Assets Held ≤1 Year)

Short-term gains are taxed as ordinary income, which means they use the standard federal income tax brackets with rates ranging from 10% to 37%.

Calculate How much is Capital Gains Tax: A Step-by-Step Walkthrough

Calculate How much is Capital Gains Tax: A Step-by-Step Walkthrough

A robust calculator automates complex math, but knowing what goes into it helps you plan. Here’s what you’ll typically input and how the calculation works.

Essential Inputs for an Accurate Estimate

Initial and Sale Value: Enter the purchase price (cost basis) and the final sale price of your asset.

Holding Period: Specify whether you owned the asset for more or less than one year. This is the key determinant of your tax rate.

Filing Status & Annual Income: Input your tax filing status (single, married, etc.) and your total taxable income from other sources (like wages). Your ordinary income fills up the lower tax brackets first, which then determines the rate applied to your capital gains.

Location: Don’t forget how much is state capital gains taxes. While nine states (like FL, TX, and NV) have no income tax, others like California tax capital gains at rates up to 13.3%.

Real Calculation Examples

Here’s how the math breaks down in two common scenarios using 2025 rates:

Example 1: Long-Term Gain for a Single Filer

Salary: $50,000

Long-Term Capital Gain: $15,000 (from stocks held for 2 years)

Total Taxable Income: $65,000

Calculation:

The $50,000 salary fills the entire 0% long-term bracket ($0-$48,350 for single filers).

The remaining $1,650 of salary and the entire $15,000 gain fall into the 15% long-term bracket.

Tax on the Gain: $15,000 x 15% = $2,250.

Example 2: Short-Term Gain for a Married Couple Filing Jointly

Salary: $150,000

Short-Term Capital Gain: $30,000 (from crypto held for 6 months)

Total Taxable Income: $180,000

Calculation:

Short-term gains are added to ordinary income. The $30,000 gain falls within the couple’s 22% income tax bracket.

Tax on the Gain: $30,000 x 22% = $6,600.

Advanced Factors & Additional Taxes

Advanced Factors & Additional Taxes

High-income investors and real estate sellers must account for extra layers of taxation.

Net Investment Income Tax (NIIT): A 3.8% surtax may apply to investment income (including capital gains) if your Modified Adjusted Gross Income exceeds $200,000 (single) or $250,000 (married filing jointly).

Depreciation Recapture (Real Estate): For rental or business property, depreciation claimed during ownership is “recaptured” and taxed at a maximum rate of 25%, separate from the capital gains rate.

Alternative Minimum Tax (AMT): In some cases, especially with large gains or incentive stock options, you may need to calculate your tax under the AMT system, which has fewer deductions.

Top Strategies to Legally Minimize How much is Capital Gains Tax

Top Strategies to Legally Minimize How much is Capital Gains Tax

Beyond using a capital gains tax calculator to calculate how much is capital gains tax for planning, these proactive strategies can help you retain more of your profits.

Harvest Tax Losses: Sell underperforming investments at a loss to offset gains from winners. You can deduct up to $3,000 in net capital losses against ordinary income annually and carry forward excess losses.

Hold for the Long Term: Whenever possible, hold investments for over a year to qualify for the lower long-term rates. The tax savings can be dramatic.

Leverage Real Estate Exemptions & Deferrals:

Primary Home Sale: Exclude up to $250,000 ($500,000 if married filing jointly) of gain from the sale of your main home if you’ve lived there for 2 of the last 5 years.

1031 Like-Kind Exchange: Defer all capital gains taxes on investment or business property by reinvesting the sale proceeds into a “like-kind” property within strict timelines.

Invest in Tax-Advantaged Accounts: Grow investments in IRAs and 401(k)s to defer or eliminate taxes on capital gains and dividends.

Time Your Sales Strategically: If you anticipate being in a lower income bracket in the future (e.g., after retirement), consider deferring the sale of assets to pay a lower rate.

Comparing how much is Capital Gains Tax Minimization Strategies

| Strategy | Best For | Key Benefit | Complexity |

|---|---|---|---|

| Tax-Loss Harvesting | Investors with losing positions | Directly reduces current-year tax bill | Low |

| Holding >1 Year | All investors | Qualifies for lower tax brackets | Low |

| Primary Home Exclusion | Homeowners selling their residence | Up to $500k gain excluded from tax | Medium |

| 1031 Exchange | Real estate investors | Defers tax, preserves equity for reinvestment | High |

| Retirement Accounts | Long-term retirement savers | Tax-deferred or tax-free growth | Medium |

Reporting how much is Capital Gains Tax: Required Tax Forms

Reporting how much is Capital Gains Tax: Required Tax Forms

When you file, you must report capital gains and losses to the IRS using specific forms:

Form 8949: Report details of each capital asset sale (dates, costs, proceeds).

Schedule D: Summarize your total capital gains and losses from all transactions.

Form 1040: Transfer the final net gain or loss amount to your main tax return.

Final Checklist Before You Sell

Final Checklist Before You Sell

Use this quick list with your capital gains tax calculator to ensure you’re prepared:

I have accurately calculated my cost basis, including commissions and fees.

I have confirmed my holding period (over or under one year).

I’ve used my filing status and total taxable income for an accurate rate estimate.

I have factored in state taxes and the 3.8% NIIT if applicable.

For real estate, I have accounted for depreciation recapture.

I have reviewed tax-minimization strategies like loss harvesting or timing.

When to Consult a Professional

While a calculator provides an excellent estimate, consult a qualified tax advisor or financial planner if:

You have very large or complex gains.

You are considering a 1031 exchange or Opportunity Zone investment.

Your situation involves inherited assets, business sales, or the AMT.

Using a detailed capital gains tax calculator to calculate how much is capital gains tax is the first step toward intelligent tax planning. By understanding the rates, accurately estimating your liability, and implementing strategic moves, you can confidently make investment decisions that maximize your after-tax wealth.

For precise, personalized calculations based on your unique financial picture, be sure to use the integrated how much is Capital Gains Tax Calculator on this page.

Capital Gains Tax FAQ & Additional Resources

Here are answers to the most common questions about capital gains taxes and using a calculator, followed by additional resources to help you manage your investment taxes.

❓ Frequently Asked Questions (FAQ)

General Capital Gains Tax Calculator Questions

Q1: What exactly counts as a “capital asset”?

A: A capital asset is generally anything you own for personal or investment purposes. This includes stocks, bonds, mutual funds, cryptocurrency, real estate (that isn’t your primary residence for business), vehicles, and collectibles like art or coins. Your primary home is also considered a capital asset but receives special tax treatment.

Q2: How is my cost basis determined, and can it change?

A: Your initial cost basis is typically what you paid for the asset, plus any commissions or fees. However, your basis can be adjusted. Key adjustments include:

Reinvested Dividends: For mutual funds, reinvested dividends increase your cost basis.

Home Improvements: For real estate, the cost of significant improvements (like a new roof or addition) can be added to your basis.

Stock Splits/Dividends: Corporate actions like stock splits require you to adjust your per-share basis.

Inherited Assets: Your basis is usually the fair market value of the asset on the date of the original owner’s death (“step-up in basis”).

Q3: I have capital losses. How do they work?

A: Capital losses are first used to offset capital gains of the same type (short-term losses offset short-term gains, long-term losses offset long-term gains). Any remaining losses can then offset the other type of gain. If you have a total net loss, you can deduct up to $3,000 per year against your ordinary income (e.g., wages). Any excess losses can be carried forward indefinitely to future tax years.

Calculator & Calculation Questions

Q4: Why do I need to enter my total income into a capital gains calculator?

A: Your total taxable income determines which tax bracket your long-term capital gains fall into. The 0%, 15%, and 20% long-term rates apply to specific income ranges. Your ordinary income fills up the lower brackets first; your capital gains then “sit on top” of that income and are taxed accordingly.

Q5: Does the calculator account for state taxes?

A: It depends on the sophistication of the tool. A basic calculator might only estimate federal taxes. A comprehensive one will ask for your state of residence and apply the appropriate state capital gains tax rate, which can range from 0% (in states like Texas or Florida) to over 13% (in California). Always check what your calculator includes.

Q6: I sold an inherited house. How do I calculate the gain?

A: For inherited property, your cost basis is usually the fair market value at the date of the decedent’s death. Your gain is the sale price minus this “stepped-up” basis, minus any selling expenses. This often results in a much smaller taxable gain compared to selling a property you purchased yourself.

Strategy & Specific Situations

Q7: Is there any way to avoid capital gains tax legally?

A: While completely avoiding tax is rare, several strategies can minimize or defer it significantly:

Hold for over one year to qualify for lower long-term rates.

Use the primary home exclusion ($250k/$500k exclusion).

Harvest investment losses to offset gains.

Donate appreciated stock to charity (you avoid the capital gain and get a deduction for the full market value if you itemize).

Use a 1031 exchange for investment real estate to defer all gains.

Q8: How are capital gains on cryptocurrency taxed?

A: The IRS treats cryptocurrency as property. Every sale, trade, or use of crypto to pay for goods/services is a taxable event that may trigger a capital gain or loss. You must calculate your gain (sale price minus cost basis) for each transaction. Holding for over a year qualifies for long-term rates.

Q9: What is the “wash sale rule,” and how does it affect me?

A: The wash sale rule disallows claiming a loss if you sell a security at a loss and purchase a “substantially identical” security 30 days before or after the sale. The disallowed loss is added to the cost basis of the newly purchased security. Important: This rule currently applies to stocks and securities but does not apply to cryptocurrency (as of 2024 tax law).

Q10: When should I definitely consult a tax professional instead of relying on a calculator?

A: Seek professional advice for:

Large or complex transactions (e.g., selling a business, large real estate deal with depreciation recapture).

Executing a 1031 exchange (strict rules and timelines apply).

Gains related to incentive stock options (ISOs) which can trigger the Alternative Minimum Tax (AMT).

Situations involving trusts, estates, or foreign assets.

📚 Glossary of Key Terms

Adjusted Cost Basis: Your original purchase price, plus certain costs (like improvements or fees), minus any deductions (like depreciation).

Capital Gain/Loss: The difference between the sale price of an asset and its adjusted cost basis. A profit is a gain; a loss is a loss.

Depreciation Recapture: When selling a rental or business property, the portion of the gain attributed to depreciation deductions taken previously is taxed at a higher rate (up to 25%).

Long-Term Capital Gain/Loss: A gain or loss on an asset held for more than one year before selling.

Net Investment Income Tax (NIIT): A 3.8% tax on certain investment income (including capital gains) for individuals with income above specific thresholds.

Realized Gain/Loss: A gain or loss that occurs when you actually sell an asset. An unrealized (paper) gain/loss exists while you still hold the asset.

Short-Term Capital Gain/Loss: A gain or loss on an asset held for one year or less before selling.

Step-Up in Basis: The adjustment of the cost basis of an inherited asset to its fair market value at the date of the decedent’s death.

🚀 Next Steps & Action Plan

Gather Your Data: Before using the calculator, collect information on your asset’s purchase price (and any basis adjustments), sale price, and dates. Have your most recent tax return handy to estimate your income.

Run Multiple Scenarios: Use the calculator to model different outcomes. What if you sell this year vs. next year? What if you sell a losing position to offset the gain?

Review Strategies: Re-examine the minimization strategies in the main article. Could tax-loss harvesting or holding a few more months make a meaningful difference?

Document Everything: Keep impeccable records of all transactions, calculations, and the rationale for your decisions (especially for tax-loss harvesting).

Schedule a Consultation: If your situation is complex or the tax liability is significant, schedule a meeting with a CPA or tax advisor to review your plan.

Final Reminder: A capital gains tax calculator is a powerful planning tool, but it provides an estimate. Tax laws are complex and change. Use this guide and calculator to become informed, make smarter decisions, and know when to seek expert help to ensure compliance and optimize your financial outcome.

Ready to Calculate Your Specific Liability?

Use the integrated Capital Gains Tax Calculator on this page with your real numbers. Input different scenarios to see how timing, income changes, and strategies can affect your bottom line. Start planning today to keep more of your hard-earned investment profits.

2024 & 2025 Capital Gains Tax Calculator Rates

2024 & 2025 Capital Gains Tax Calculator Rates Calculate How much is Capital Gains Tax: A Step-by-Step Walkthrough

Calculate How much is Capital Gains Tax: A Step-by-Step Walkthrough Advanced Factors & Additional Taxes

Advanced Factors & Additional Taxes Top Strategies to Legally Minimize How much is Capital Gains Tax

Top Strategies to Legally Minimize How much is Capital Gains Tax  Reporting how much is Capital Gains Tax: Required Tax Forms

Reporting how much is Capital Gains Tax: Required Tax Forms Final Checklist Before You Sell

Final Checklist Before You Sell